Find Out 14+ Facts Of Beta Vs Standard Deviation People Forgot to Let You in!

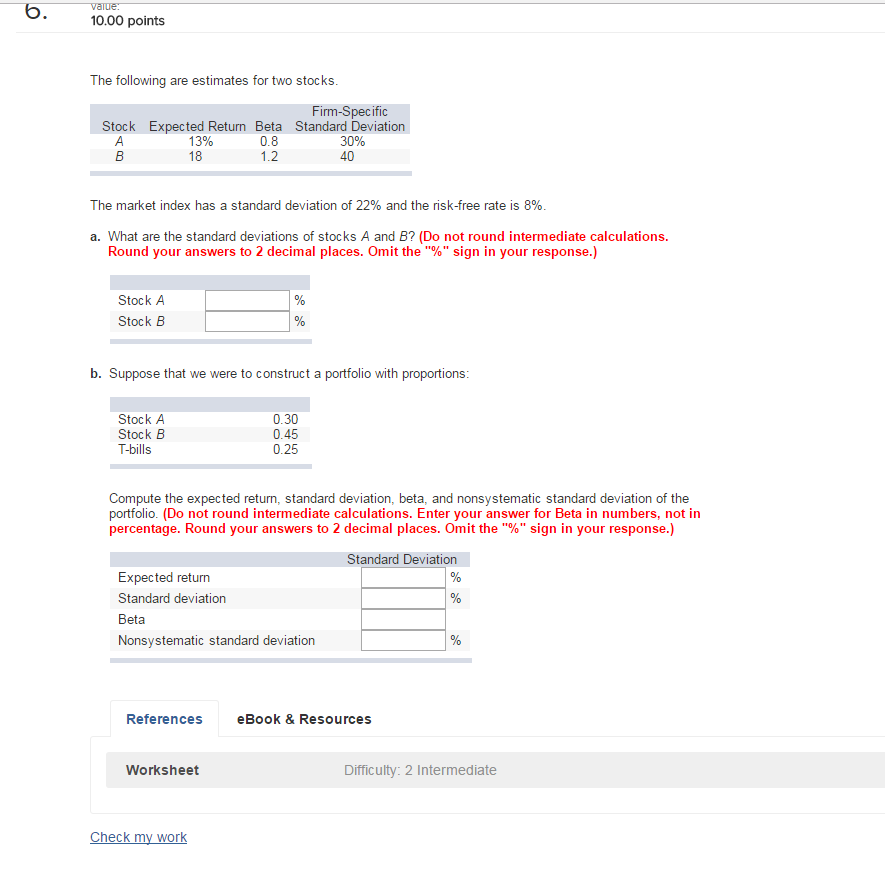

Beta Vs Standard Deviation | Let's begin this post with a gross generalisation: Finding beta of stocks & portfolios, expected returns, standard deviations, and the capm ok. On the other hand, standard deviation is the square root of that variance. Beta shows the sensitivity of a fund's, security's, or portfolio's performance in relation to the market as a whole. Standard deviation is a measure of the total variability of an investment or an investment portfolio regardless of its source.

Both beta and standard deviation are two of the most common measures of fund's volatility. Sorry if this is a basic question, but i'm having trouble explaining the difference between kurtosis and standard deviation. It can, however, be done using the formula below, where x represents a value in a data set, μ represents the mean of the data set and n represents the number of values in the data set. Expected return and standard deviation are two statistical measures that can be used to analyze a portfolio. In simple terms, the closest to zero the standard deviation is the more close to the mean the values in the studied dataset are.

Higher standard deviation does naturally lead directly to higher beta, but for diversified portfolios only, not necessarily for individual securities. It can, however, be done using the formula below, where x represents a value in a data set, μ represents the mean of the data set and n represents the number of values in the data set. So, using the standard deviation we have a standard way of knowing what is normal, and what is extra large or extra small. A low standard deviation indicates that the values tend to be close to the mean. Its symbol is σ (the greek letter sigma). One technical answer is that the beta of y on x is the correlation coefficient between y and x, times the standard deviation of y, divided by the however finance has popularized the idea of using beta as a risk measure, which makes it similar to standard deviation. 1xresearch source once you know what numbers and equations to use, calculating standard deviation is simple! Both beta and standard deviation are two of the most common measures of fund's volatility. A security price with high standard. Submitted 2 years ago by detharatsh. Amateur traders tend to use a funky little number called the atr: B.beta measures total volatility, while standard deviation measures total risk. The standard deviation study plots standard deviation of price on the specified time period.

In statistics, the standard deviation is a measure of the amount of variation or dispersion of a set of values. A security price with high standard. In simple terms, the closest to zero the standard deviation is the more close to the mean the values in the studied dataset are. 6:04 yadnya investment academy 32 107 просмотров. After calculating beta and standard deviation for both firms, i seem to have stumbled on some weird phenomenon.

The steps in calculating the standard deviation are as follows On the other hand, standard deviation is the square root of that variance. It can, however, be done using the formula below, where x represents a value in a data set, μ represents the mean of the data set and n represents the number of values in the data set. Beta and standard deviation are measures by which a portfolio or fund's level of risk is calculated. Its symbol is σ (the greek letter sigma). Beta compares the volatility of an investment to a lower standard deviation means the investment is more consistent and moves less choppily. Amateur traders tend to use a funky little number called the atr: Let's begin this post with a gross generalisation: D.beta measures the risk investors are compensated for, while standard deviation measures both systematic and unsystematic risk. Finding beta of stocks & portfolios, expected returns, standard deviations, and the capm ok. Both beta and standard deviation are two of the most common measures of fund's volatility. Standard deviation is a measure of dispersion of the data from the mean. In 1893, karl pearson coined the notion of standard deviation, which is undoubtedly most used measure, in research studies.

Submitted 2 years ago by detharatsh. 1xresearch source once you know what numbers and equations to use, calculating standard deviation is simple! If we are simply interested in measuring how spread out values are in a dataset, we can use the standard deviation. Diffen › science › statistics. Sorry if this is a basic question, but i'm having trouble explaining the difference between kurtosis and standard deviation.

As mentioned in a previous article here for normally distributed data, the. In simple terms, the closest to zero the standard deviation is the more close to the mean the values in the studied dataset are. The standard deviation is a measure of how spread out numbers are. Diffen › science › statistics. Let's begin this post with a gross generalisation: D.beta measures the risk investors are compensated for, while standard deviation measures both systematic and unsystematic risk. The expected return of a portfolio is the standard deviation takes into account the expected mean return, and calculates the deviation from it. Standard deviation, is a measure of the spread of a series or the distance from the standard. Standard deviation is a measure of dispersion of the data from the mean. 6:04 yadnya investment academy 32 107 просмотров. Higher standard deviation does naturally lead directly to higher beta, but for diversified portfolios only, not necessarily for individual securities. It can, however, be done using the formula below, where x represents a value in a data set, μ represents the mean of the data set and n represents the number of values in the data set. In 1893, karl pearson coined the notion of standard deviation, which is undoubtedly most used measure, in research studies.

Beta Vs Standard Deviation: Let us discuss some of the major difference between variance vs standard deviation.

Source: Beta Vs Standard Deviation

0 Response to "Find Out 14+ Facts Of Beta Vs Standard Deviation People Forgot to Let You in!"

Post a Comment